Construction industry research publisher Construction Coverage just released the 2024 edition of its Home Improvement Spending Report, with some interesting data specific to the New York-Newark-Jersey City metro.

Key Findings for the New York Metro

- Last year, homeowners in the New York metro area took out 20,492 home improvement loans.

- Relative to the total number of homeowners in the NY metro, this is the 8th fewest of any large metro in the U.S. (5.4 loans per 1,000 homeowners).

- The median loan amount for NY metro borrowers was $105,000, and the median interest rate was 8.000%.

Key National Takeaways

- Amid high interest rates and elevated prices, 2023 was a down year for home improvement spending. According to loan-level data from the Home Mortgage Disclosure Act, the total number of single-family home improvement loans originated in the U.S. declined from nearly 745,000 in 2022 to just 565,000.

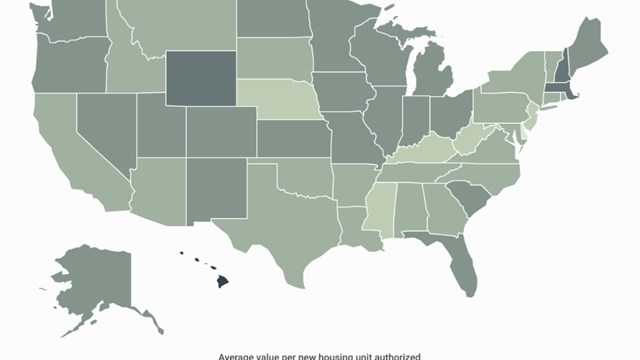

- Homeowners in Utah and Idaho—two of the top 10 fastest-growing states—managed to take out 17.0 and 13.0 home improvement loans per 1,000 homeowners, respectively—approximately 2X the national average of 6.9 home improvement loans per 1,000 homeowners.

- The Salt Lake City metro invested most into home improvements among all large U.S. metros, where 15.3 home improvement loans originated per 1,000 homeowners. The Portland (5th), Denver (8th), and Seattle (11th) metros also invested heavily.

- Other top locations included neighboring Mountain West and Pacific Northwest states in Oregon, Colorado, and Washington, as well as Rhode Island, New Hampshire, Vermont, and Massachusetts in New England.

- At the other end of the spectrum, homeowners in Louisiana took out the fewest home improvement loans, at just 2.1 loans per 1,000 homeowners. Homeowners in Mississippi, Texas, and Alaska also invested at less than half the national rate.

Leave a Comment