While the economy has largely recovered from the unprecedented uncertainty and instability brought on by the COVID-19 pandemic, the 2024 release of a report on mortgage delinquency rates by U.S. city and state conducted by Construction Coverage indicates that homeowners are facing some new challenges. Inflation has become a significant concern, and home prices—already near all-time highs—continue to climb, making it increasingly difficult for many households to afford their mortgage payments. Moreover, rising insurance costs are adding additional financial pressure, stretching household budgets thin and raising concerns about the sustainability of homeownership.

Financial assistance programs like loan forbearance, direct relief payments, and enhanced unemployment benefits worked to stave off loan delinquencies over the course of 2020 and 2021; during this period, the percentage of loans at least 30 days delinquent dropped to historically low levels across most major loan types.

Unfortunately, a combination of elevated interest rates and the end of most of these assistance programs has led to increased frequencies of missed payments. As of Q2 2024, the national share of mortgages over 30 days delinquent has risen to 3.35%.

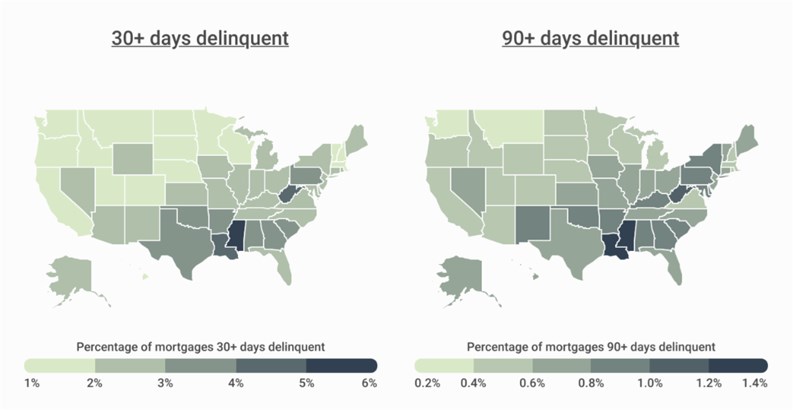

However, while mortgage delinquency rates are on the rise nationally, the concentration of delinquent mortgages varies significantly by location. For the Construction Coverage study, researchers ranked locations based on the percentage of mortgages at least 30 days delinquent as of December 2023. In the event of a tie, the location with the greater percentage of mortgages at least 90 days delinquent was ranked higher.

- In general, delinquency rates tend to be highest in areas with higher levels of unemployment and poverty, lower levels of income, and lower property values.

- Mississippi, Louisiana, and West Virginia were the top three states for both 30-day and 90-day mortgage delinquencies. Other states with high rates of missed payments include Alabama and Arkansas.

- At the opposite end of the spectrum, the West Coast had the lowest share of mortgages more than 30 days delinquent, with Washington, Oregon, and California all reporting rates of delinquent mortgages under 1.5%.

- In the New York-Newark-Jersey City, NY-NJ-PA metro area, 2.2% of mortgages were at least 30 days delinquent, lower than the U.S. average of 2.4%.

- Meanwhile, 0.7% of NY metro mortgages were over 90 days delinquent.

The full results of the analysis include data on over 260 U.S. metros and all 50 states.

Leave a Comment