While economy continues its slow recession rebound, unemployment rates remain steady at more than nine percent. Across the nation, various real estate markets have taken it on the chin, with some markets such as Detroit and Las Vegas knocked down to the canvas. However, New Jersey, like its Big Apple neighbor, seems to be bobbing and weaving, ducking the worst of the economic punches.

“Anyone seeking a sense of optimism in the New Jersey commercial real estate market need look no further than the multifamily sector heading into the final months of 2011,” says Brian Whitmer, the director of Cushman & Wakefield’s Metropolitan Area Capital Markets Group. “The best Garden State submarkets are hitting their stride and returning to strong, pre-recession fundamentals.”

Better Days Ahead?

In September, the National Association of Realtors (NAR) released its monthly report and the news was somewhat encouraging, which supports the uptick in New Jersey property sales. From August 2010 to August 2011, sales of existing single-family, townhomes, condominiums and co-ops spiked by18.6 percent. The report also found that sales on a monthly basis increased by 7.7 percent with unsold inventory dropping by three percent.

While national aggregated real estate statistics show promise, these real estate tea leaves should be read with caution. “Some of the improvement in August may result from sales that were delayed in preceding months, but favorable affordability conditions and rising rents are underlying motivations,” noted Lawrence Yun, NAR’s chief economist. “Investors were more active in absorbing foreclosed properties. In additional to bargain hunting, some investors are in the market to hedge against higher inflation.”

New Jersey like many states, including New York, has many submarkets, some of which are doing better than others. “Compared to this time last year, I think the market has improved as we are more stable in many areas,” says New Jersey Association of Realtors President Allan Dechert. “The second quarter showed, especially the Atlantic City area as well as the markets near New York City, an increase of prices year over year which is good news. I think this is an indication of what we can expect in 2012.”

Market Indicators

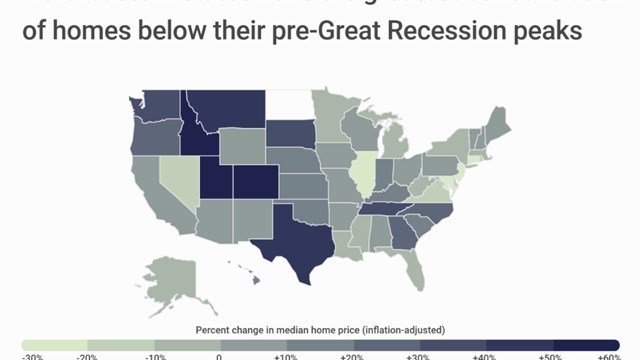

The volatile stock market and unstable, ever-fluctuating economy are impacting submarkets across the nation. There are states, however, that are doing better such as Texas, Oklahoma, Florida and New York, all of which have experienced gains between one and two percent. New Jersey is not far behind although the state Department of Community Affairs (DCA) reports that the average New Jersey taxpayer paid $7,576 in property taxes in 2010, which marks a 4.1 percent jump over 2009 and the largest year-over-year increase since 2007.

High taxes aside, in some respects there is a silver lining from the recession in that no new construction has commenced which has led to greater demand and higher absorption rates in certain areas. Essentially, the real estate market, as it pertains to available properties, is taking care of itself although inner cities are still hurting.

“In general, analysts see an upward trend in rents because there is virtually no new construction and mortgages are so difficult to obtain,” says Jerry Cheslow, vice president of The Property Owners Association of New Jersey, Inc. “We are seeing downward pressure in the inner cities because so many of our tenants are on public assistance or unemployment.”

Overall, interest rates remain low and federal programs such as Fannie Mae and Freddie Mac offer options, but for many investors, there are too many regulations attached. Additionally, beginning in 2012, Fannie Mae and Freddie Mac will gradually increase fees charged to lenders, which will likely lead to a raising of property prices until new construction is delivered to the market.

Capitalizing on the forward motion experienced in some markets in New Jersey, leading multifamily investors, owners, developers and brokers attended The New Jersey Apartment Summit on November 2.

“New Jersey is the most densely-populated state with anchor cities of New York and Philadelphia, contributing factors to the strength of the state's multifamily industry,” says Brian Klebash, president of CapRate Events, LLC and organizer of the summit. “Additionally, the region continues to attract capital from the myriad of new investors, while developers are breaking ground on new projects. This is an exciting and new event for commercial multifamily executives and service providers in the apartment arena.”

With more condominiums being converted to rentals to assist investors, an increase in rentals is good news for both unit owners and building owners. “Apartments are back. For the first time in years, conditions affecting our industry are truly positive. Rents are rising and vacancies declining and there is a belief among investors that apartments are where they want to be,” says Alan R. Hammer, an attorney with the Roseland-based law firm of Brach Eichler L.L.C.

With regard to the co-op and condominium market specifically, there is also cause to be optimistic. “The condominium market is doing pretty good. Existing co-op and condo sales are up compared to last year,” says Dechert. “I’m down in the Jersey Shore by Avalon and we are seeing a lot of activity in those areas. There are some great buys out there which is bringing more people to the market.”

According to Cushman & Wakefield, new construction starts in the Northern New Jersey market came to a virtual standstill during the downturn due in most part to a lack of financing, yet that is beginning to reverse as well. The moons are starting to align, where rents justify the creation of new supply. Equity and debt are available again, which has put developers back into play, the report said. “In total, 1,097 units are under construction, with completion dates beginning this fall through 2013,” says Whitmer. “Major developments are underway in Wood-Ridge, North Bergen, Harrison, Lyndhurst, Hoboken and Jersey City. Each of these projects is an infill development, and four of the six are transit oriented. This trend of development in New Jersey’s more urban, dense communities ringing Manhattan, especially involving projects with easy public transportation access to the city, reflects the future of multi-family growth here. Absorption rates for newly constructed luxury units are setting records, especially at communities offering easy mass transit to Manhattan, where up to 70 leases per month are being signed.”

Jobless Rate Impacting Submarkets

While encouraged by the positive industry buzz, others are taking a measured approach to the market as historically real estate recovery rides in tandem with job recovery. According to the state Labor Department, for the month of August unemployment was a 9.4 percent. Private sector payrolls were down by 11,300 over the month, while public sector jobs were up by 4,200.

“We work in Newark, where residents are impacted by cuts in aid. When the federal budget is cut, roughly one-third of the cuts are felt on the local level. That means decreased aid to tenants who need a safety net when they lose their jobs,” says Cheslow. “Many of the aid organizations, such as Catholic Charities and the Puerto Rican Action Board run out of money quickly, which means more evictions,” he continues. “Also, in Newark, the official unemployment rate is about 16 percent, but local politicians claim that the real rate is more like 28 percent. That means more people are doubling up or delaying starting a family.”

As Democrats and Republicans hem and haw on how best way to rebuild the economy, only small steps are being realized in Washington D.C. Likely, this slow pace will continue as the presidential election ramps up. In addition, the president raised the debt ceiling in August (the seventy-fourth time since 1962). Now in an attempt to find an additional $1.5 trillion in debt savings over a ten-year period, a bipartisan “super committee” has been selected and remains busy working on this goal on Capitol Hill. What does this mean for depressed real estate markets like New Jersey? Only time will answer this question.

“When it comes to the market, buyers’ decisions are impacted in part by the strength of the market, jobs, financing, and consumer confidence in general,” says Dechert. “If the stock market is up one day and then down the next two, it doesn’t look good. With that said, we are optimistic about the first two quarters of 2012 as we think there will be a building on the current momentum in the state.”

Cheslow focuses on the inner city market and isn’t as convinced recovery is on tap in 2012. This is due, in part, to the many question marks surrounding the state’s overall economy and how related answers will impact jobless rates and real estate activity.

“Today, it’s difficult to get non-recourse loans for buildings in inner cities, which means that the buyers need to sign personally and put their personal assets on the line. In the past, good operators with excellent records could form single-asset LLCs and get non-recourse money, which meant that the loan was secured only by the building,” says Cheslow. “Because of the increased risk and because of the decreased tenant pools, demand for these buildings has decreased. About two years ago, a good formula for apartment building pricing in the South Ward of Newark was $50,000 to $60,000 per unit, making a 20-unit building worth approximately $1 million to $1.2 million. Now, we are being offered deals at $35,000 to $40,000 per unit. And there are few takers.”

Looking forward, New Jersey is better positioned than most markets in the nation; however, depending on the area, it is difficult to forecast recovery because according to a recent Bloomberg report, the national unemployment rate is not expected to return to a “safe’ six percent until 2015. If a rebound of the real estate market is dependent on jobs, government incentives might be required to assist in the recovery, which could help young professionals and families new to the market a chance at ownership.

W.B. King is a freelance writer and a frequent contributor to The New Jersey Cooperator.

Leave a Comment