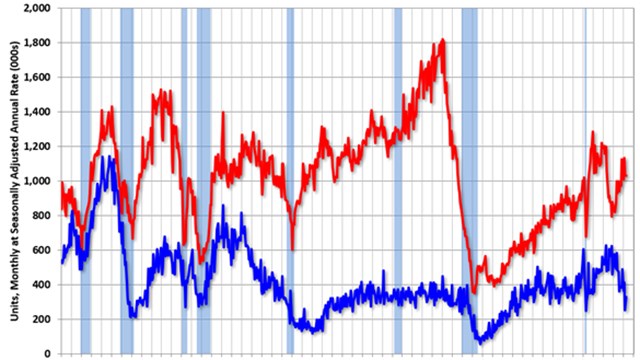

The doubling of interest rates in the past 18 months has certainly had a chilling effect on sales of all types of private homes, whether they be condos high in the sky, co-ops in quaint, pre-war walk-ups, or detached single family homes in manicured HOAs. The cost of ownership has gone up with just about everything else. No real relief is expected in the near future, and there are those in the world of economic prognostication who believe the era of artificially low borrowing costs is over and never to return.

Thinking Outside the Conventional

Conventional wisdom has dictated that the most beneficial financing for home ownership was the 25- to 30-year self-amortizing mortgage. That product fixed home ownership costs for the longest time, and more often than not dovetailed with the goals and behavior of homeowners themselves. Chances were you’d pay off your mortgage while living in your home. Rates became so low that even 15-year mortgages became manageable, despite their higher amortization costs.

Now, however, the climb in interest rates - and the commensurate increase in monthly mortgage payments - has priced many prospective buyers out of the market. The drop in prices required to bring monthly payments down has caused many potential sellers to take their units off the market. The result has been higher costs and lower inventory - not a good place for the market to be.

What can we do to change this dynamic? A creative approach may be the solution. Benjamin Dixon, a broker with Douglas Elliman in New York City, suggests there are a couple of ways we can look at the picture and try to tailor it to buyers’ needs. “We can consider adjustable rate mortgages, known as ARMs, or we can look at a buy-down of the interest rate.”

ARMs

AMRs, adjustable rate mortgages, have been around for a long time, at least since the last period of high interest rates. Essentially, they carry a term of say twenty-five years, but the interest rate is not fixed for the entire term. It changes every three, five, seven, or 10 years.

According to Dixon, “Not every borrower needs to fix costs for 25 years. Say perhaps that the purchaser is a young couple who see their space needs growing over time. They may intend to stay in the unit for five years, and then move. They don’t need a 25-year mortgage. The rate on a five-year ARM may be substantially lower than for a 25-year fixed rate. We suggest and encourage them to consider a shorter interest rate fix.” This will save them money and add flexibility.

Buydowns

Another option, explains Dixon, who is also a CPA and very familiar with the math behind mortgages, is to ‘buydown’ the rate. A rate buydown is the payment of a flat fee up front to the lender to reduce the interest rate. This flat fee is also known as paying points. “For every one point you pay,” Dixon explains, “the bank rate will reduce the interest rate on the mortgage by a quarter point. On an overall face amount of a $1 million mortgage, the interest rate reduces by 25 basis points (one quarter of a point) or approximately $165 per month at current rates.”

Dixon says that while he does see rate buydowns, he doesn’t see them often, as they can become expensive. To carry out our example above, a prospective borrower would have to pay 12 points to buy down a mortgage by 3%. That translates to $120,000 in our example. What Dixon suggests is that a reflection of this buydown could come in the form of a negotiation with the seller to have the seller absorb this cost by paying certain closing costs. These costs could include fees associated with interest or other closing costs and charges.

The key today is to get creative and to make the deal - and that requires thinking outside the conventional.

Leave a Comment