Both locally and nationally, 2022 was a year of contradiction in the real estate industry. The year began on the coattails of one of the strongest markets for homes in recent history. By early spring, with inflation rising at speeds not seen in four decades, and partly fed by price increases in both owned and rented homes and apartments, concern over potential interest rate increases to fight inflation was in the air. Over the course of the year, the Federal Reserve raised interest rates four times, doubling the available interest rate for home purchases from around three percent to near seven percent. Yet for now, according to industry analysts and experts, housing prices have not declined.

A Deeper Dive

The story of 2022 is not solely one of rising interest rates. It is composed of multiple factors that resulted from the COVID pandemic that began in 2020. One of the most defining features of the crisis was the frenzy of home sales fueled by city dwellers making the move to suburbs—in the tristate area, and throughout the country. The availability of financing at historically low interest rates accelerated that trend. While initially a marked exodus from cities to suburbs, by 2021 urban markets began to spring back—and the appetite for apartments was ravenous.

“[The year] 2021 was a rocket ship for sales,” says Jonathan Miller, CEO and principal of Miller Samuel Real Estate Appraisal and Consulting, located in New York City. “With the tremendous surge in sales activity, inventory was obliterated. It was scraped clean because mortgage rates were too low for too long. This led to record home prices throughout the region, bidding wars, huge sales volume, and ultimately inventory collapse. A year later, in the spring of 2022, mortgage rates began to rise. The New York/New Jersey region, though, is still characterized by prices rising, but at a slower rate.”

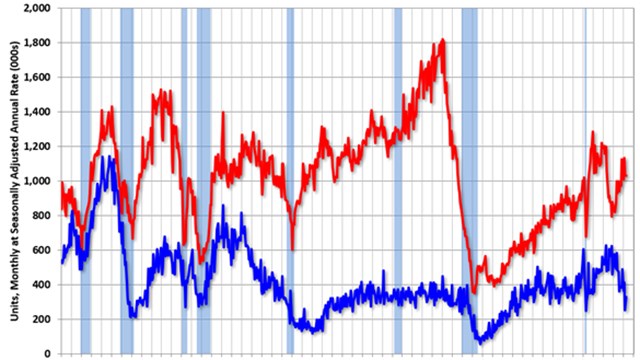

Even more than the increase in interest rates, those record sales in 2021 resulted in the volume of sales dropping in 2022. “Sales go negative on a year over year basis,” says Miller. “That’s the number of properties sold relative to the number sold in the same period in the prior year. What was somewhat unexpected in the New York-New Jersey metro area is that inventory is flat and/or declining. Some subsets are rising, but overall we are seeing falling inventory. It’s unusual historically, but the trend we see is that because mortgage rates were at record lows prior to spring 2022, many people either purchased during the pandemic or refinanced; now they’re wedded to their rates and are therefore reluctant to become buyers.” Meaning they’re not listing their homes or apartments for sale.

“In a lot of markets,” reiterates Miller, “inventory is half what it was before the pandemic. The metric to focus on for 2023 is this lack of inventory. The inventory picture to focus on to understand the problem is Darien, Connecticut, as an example. Pre-pandemic inventory in Darien was floating at around 200 units, depending on seasonal factors. After lockdown, inventory dropped to say 50 units in the same market. A year later, before rates went up, inventory fell to 12 units.”

Interest Rates

The increase in interest rates was meant quite specifically to drive down inflation. The Fed views an overheated housing market as part of the inflation problem. While homeowners may be celebrating a level of equity they may never have imagined in their homes, that same inflated price is disrupting other aspects of their home economics. That’s not to say that the run-up in home prices caused by an overheated market is the main culprit in inflation, but it reflects the overall problem.

The Fed is expected to continue raising interest rates into 2023 to battle inflation. The question is how has that and how will that continue to affect the market for homes? “The Fed expected to continue raising rates,” says Miller. “Increasing rates create uncertainty in the market. Buyers can wrap their heads around higher rates, but if it happens every six weeks it’s a problem. It’s too much for the buyer to process and too quickly. One of the problems in today’s market is that it is clearly less affordable with higher rates. On the other hand, for most buyers today, it doesn’t make sense to fix their monthly costs on a thirty-year basis, as few live in a home for thirty years. Adjustable-rate mortgages such as 7/1s, 5/1s, and other hybrids with conversion down the road are still low and as low as before the spike.”

What’s Ahead?

Miller’s crystal ball, which he says is held together with duct tape, suggests that what happens in 2023 depends on whether rates continue to rise. “You can’t predict the Fed. The expectation is that there will be at least a couple more increases. Ironically, the reason for continuing to increase rates is that the economy is showing strength. We are expecting less units will be sold overall in 2023 than in 2022. But that depends on the direction of rates. Normally, we don’t over emphasize rates, but because they have gone up so dramatically and the economy is still robust it’s not a dire situation for the housing market yet, just less activity. We don’t see a strong expectation of negative price trends. If any, they will be modest if current conditions remain the same.”

The View from the Trenches

“The controlling trends in 2022 were a continuation of 2021 which was a rebound from the pandemic,” says Eugene Cordano, President of Brown Harris Stevens New Jersey. “Pricing went way up in 2022, though co-ops and condos lagged a bit behind single-family homes. The 2022 trend line was interest rates. As interest rates rose, they slowed the market—but not all sectors. Properties priced above $800,000 had velocity. They were still getting multiple bidders, but not bidding wars—and not at 20 or 30 percent over asking price. For qualified, capable buyers, another point in interest cost wasn’t killing them. Those who still were looking are still active. There were no real discounts, though, from the interest rate increase in terms of pricing. You would think in a slowdown there would be a drop in prices, but you’re not seeing that. Qualified buyers have a better chance of getting the house they want because there isn’t a bidding war of 20 or 30 people going after it.” Cordano adds that “the dearth of inventory is a main reason for no price breaks—though the main consideration is that the numbers are still affordable to the buyer.”

Diana Sutherlin, founder of the Sutherlin Group at Compass in their Jersey City office, says, “Interest rates (7/1 ARMS) have been a hot topic, especially for those first-time home buyers and people purchasing moderately priced homes, many of whom were priced out of the market. The luxury market was very active with bidding wars, cash transactions, and trophy properties moving at a swift pace. Paired with a lack of inventory, these trends made for a very competitive, high-energy market. There was a lot more inventory for one- and two-bedrooms as select condos lingered on the market. Many sellers had to adjust pricing in specific categories, especially based on location.

“A slowdown will happen with a bit more increase in interest rates,” Sutherlin continues. “The lack of inventory will remain, which means we will still be in a seller’s market. We will continue to see people rent their homes. While prices will remain steady in the luxury market, we will continue to see buyers from Manhattan and Brooklyn as demand remains. As the rental market surges, the idea for many of those who have come from different markets is to convert them into buyers—especially with rental prices. This makes for an exciting market as the demand remains strong and inventory lacks! This is especially unique to the urban markets.”

Megan Fox, co-founder of Fox & Stokes team at Compass in Bergen County, says, “The newer condos were trading much faster than homes that needed updates. After all, there is something to a turn-key home, especially when decorating and furniture lead times have become more of a burden than a creative and fun project. This was a much more competitive market—we found that many people decided to downsize to condos and there was definitely less inventory. Interest rates and HOA fees are a critical factor as well. Many people think they want amenities, but they don’t end up using them. It’s very important to make a list of your priorities, and stick to the list! As people return to work, they are also seeking condos, some even want to use them as pieds-à-terre.”

Fasten your seatbelts. Looks like 2023 is gonna be a bumpy ride!

A J Sidransky is a staff writer/reporter for CooperatorNews, and a published novelist. He can be reached at alan@yrinc.com.

Leave a Comment